Debt Emergency in African Countries: A Sustainable Proposal for Jubilee 2025

28.06.2024

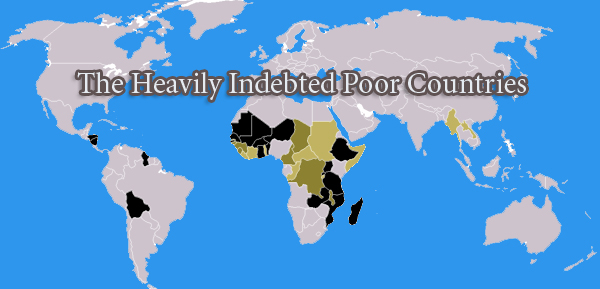

The recent global financial turbulence, highlighted by the protests in Kenya after the passage of the new finance bill, has once again focused attention on the issue of debt. The issues at stake are very high, especially for African countries facing an unprecedented debt emergency.

Father Giulio Albanese, of the Vatican Secretariat of State, in an article published in L’Osservatore Romano, pointed out that “in the face of this scenario, the turbulence on the disadvantaged countries, primarily those in Africa, is such that they are already those who are paying the consequences more than others. We are talking about economies with high rates of informality and therefore low tax revenues, high dependence on foreign countries for essential goods and therefore high exposure to international price fluctuations, the need to borrow in dollars or euros with the consequent diversion of a large part of export revenues to debt service payments’.

As Father Giulio himself explicitly stated, quoting LINK 2007 on the Rai News 24 news broadcast a few days ago, a concrete and feasible solution to get out of the spiral of growing debt and create new opportunities for sustainable growth has been proposed several times by LINK 2007 with the ‘Release’ initiative. This proposal rekindles attention on the debt conversion of the poorest countries, an idea already presented at the G20 in 2021 under the Italian presidency and today even more relevant in light of the multiple crises – economic, political, climate – that afflict billions of people around the world.

In this context, financial institutions, both national and international, are called upon not to limit themselves to merely suspending the payment of debt, but to carry out its conversion, in some cases even providing for its partial or total cancellation, demanding in exchange a precise commitment from the debtor country. In fact, it should create a counterpart fund in local currency earmarked for sustainable investments: a real ‘SDG Fund’, country by country, nominally equivalent to the value of the net reduction of principal and related interest, which would be waived, with the aim of achieving the Sustainable Development Goals. This increases ownership, policy alignment and commitment of ‘debtor’ countries.

Recently, Pope Francesco also emphasised the importance of the debt issue and called for cancelling or at least reducing the external debt of the poorest countries on the occasion of the next Jubilee. The Pontiff urged to think of a new, bold and creative international financial architecture that takes into account the global significance of the problem and its economic, financial and social implications. According to Pope Francesco, breaking the financing-debt cycle requires the creation of a multinational mechanism based on solidarity and harmony among peoples.

An operation of this magnitude will have to involve all creditor countries, from the Paris Club to the G20, the BRICS, and the Gulf, not least because private creditors are in some cases outnumbering the public ones, the IMF and the World Bank.

Certainly, action on the debt of countries during the Jubilee of 2025 will have to be articulated and effective, to avoid repeating the mistakes made on the same issue after the Jubilee of 2000.

LINK 2007 will continue to work on the issue of debt and proposes to relaunch the initiative at the Jubilee to promote a lasting and sustainable solution for the benefit of the most vulnerable countries.